Mortgage note investment can fast track your ability to retire with ease – and retire early!

Most of us are familiar with the traditional retirement script.

Get up early to a blaring alarm clock. Drag yourself to job (just over broke). Work a 9-5 job for 30-40 years. Scrimp and save money. Retire from said job. Live your last few years of life fulfilling dreams deferred while working hard. The reality is you may be too old, sick, or just plain too tired to enjoy those golden years.

True economic freedom comes with less job dependency and with other solutions to bring in income and the escape the rate race. Most of us are trained to be good employees. However, we must take control of our futures and retirements.

You do not have to wait until you are too old to enjoy your life!

What If we told you there was another way to live your dreams now, versus waiting for unknown future. Mortgage note investment. Become the bank. With simple, consistent wealth building. Leave a financial legacy.

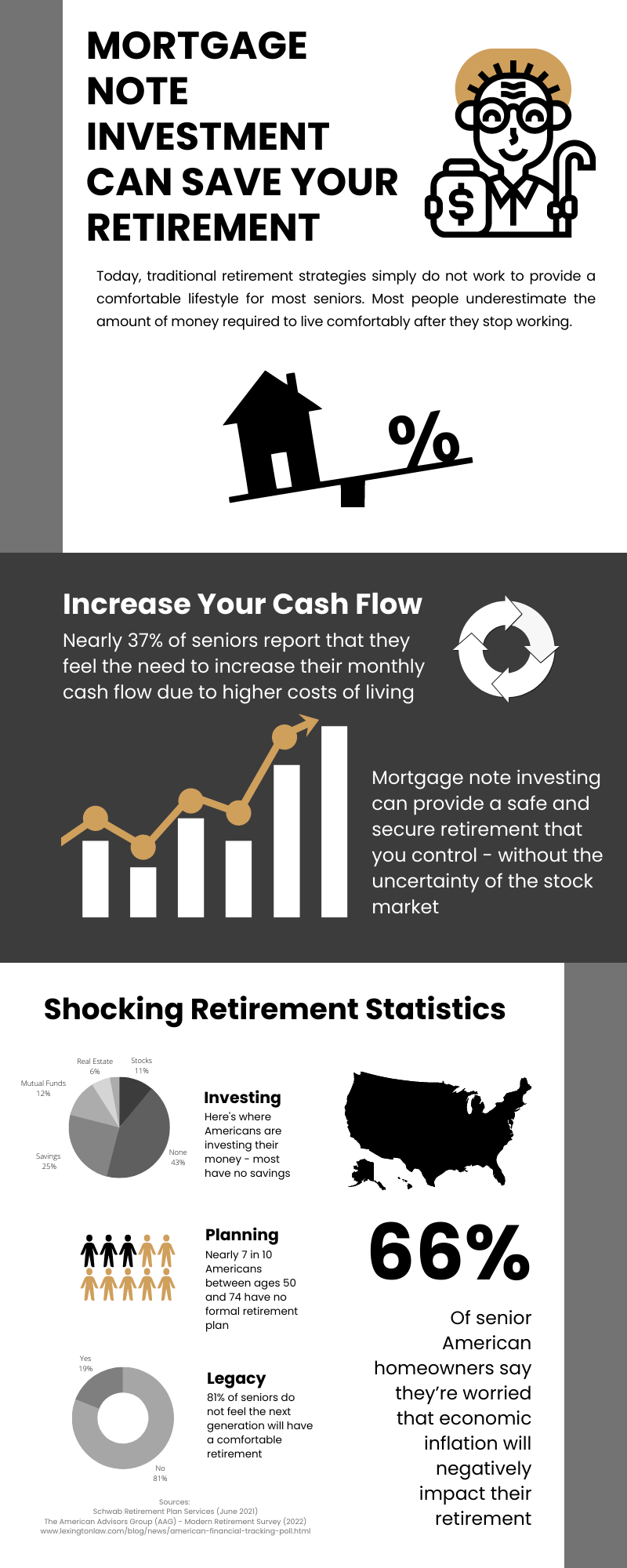

Scary Retirement Statistics

Let’s face it most Americans are not saving enough for retirement. According to the American Advisors Group, 70% of Americans 50-74 years of age have no retirement savings. Thirty-seven percent of seniors feel that they need more cash flow than they currently have.

How Most People Invest for Retirement

Savings Accounts

A savings account is one of the worst ways to save for retirement, let alone build wealth. Currently, inflation is out of control. It costs more to buy food, gas, clothing, and everything else! At best, your money is sitting in the bank a getting 1%-2% interest rate at best. Yet, mortgage notes can generate annual yields of 9-12% or more!

Stocks and Crypto

Yes, crypto is cool. And stocks and mutual funds are the standard of retirement vehicles. However, you have very little control over what happens with your crypto and stocks. Note investing is actually safer than stocks and crypto. You control the mortgage notes you want to purchase.

Real Estate Landlording

Most people think becoming a landlord is the best way to retire with cash flow. But, tenants, trash, and toilets get in the way. Getting calls from renters at night because of problems with property is a pain. Having to repair properties and coping with unruly tenants gets old quick.

When renters stop paying, you are left with having to come up with mortgage payments. To make matters worse, some jurisdictions, localities have made it difficult to evict problematic tenants. Landlording works for some. But, most people simply get tired of the drama and want to find other ways to grow wealth.

Why Note Investing

With note investing, you are the lender. As a lender, you are using property as collateral. You become the bank…just as a bank lends its money. Note ownership is a slow, but steady way to have consistent cash flow month after month.

Mortgage Note Investment Benefits

Freedom to live how you want

Control over your investments

Instant equity

High profitability with predictable outcomes

Self-Directed IRAs (SDIRA)

Have a low performing individual retirement account (IRA) or old 401k/403B/457? You can transfer or roll over money to a self-directed IRA custodian which you can use to buy notes. With IRAs, you can invest in most things except life insurance policies and collectables.

Note profits are sheltered from taxation with self-directed IRAs. Even better with Roth IRAs, there is no tax ever on distributions. With Traditional IRAs, money grows tax deferred. Withdrawals should be taken after age 59 ½. Withdrawn funds earlier than that age will be taxed at an ordinary income tax rate and penalized 10%. A Traditional IRA can be converted to a Roth with no penalty, but you will have to pay tax on that amount.

IRAs do not go through probate. So, any profits go to beneficiaries directly and are not taxed.

Health Savings Accounts

A self-directed Health Savings Account (HSA) is also a great way to purchase notes. HSAs are available with high deductible health insurance plans. In fact, they may be better than IRAs to shelter wealth.

With HSAs, you can do a one-time transfer funding of a health savings account from an IRA without taxation up to the annual contribution limit. For example, if you have $5000, you can have it transferred from a Traditional IRA to an HSA without any of that amount being taxed!

You May Also Want to See:

- CFD vs. Mortgage/Deed of Trust – What’s the Difference?

- Unlocking Cash Flow: Harness Mortgage Note Investing and Be Your Own Bank

- Demystifying Mortgage Note Investing: How to Get Started Now!

- 8 Ways to Make Money with Real Estate Note Investing

- Top 3 Reasons Why Note Investing Is the Future of Investing